Is your school district stuck in the slow lane? Fragmented data, manual workflows, and outdated systems are dragging down performance, wasting resources, and ultimately hurting student outcomes. You're not alone. Our research shows these are common problems facing districts across the country. The good news? There's a solution.

These challenges cripple performance, inflate costs, and ultimately impact student outcomes. Decreased staff productivity, hampered decision-making, and slow data access impede overall effectiveness. Redundant tasks, paper-based processes, and outdated systems drain resources. Delays in interventions and data-driven support potentially affect student achievement and personalized learning.

This is not a distant threat; it's happening right now. Every day these issues persist, districts’ and students' potential remains untapped, valuable resources are wasted, and opportunities for improvement slip away.

Imagine a single, integrated platform that:

Investing in a unified technology platform is not just an expense; it's an investment in your district's future. The benefits are multifaceted:

Investing in a centralized platform isn't just an upgrade; it's a commitment to optimizing performance, maximizing resources, and ultimately, empowering students to reach their full potential.

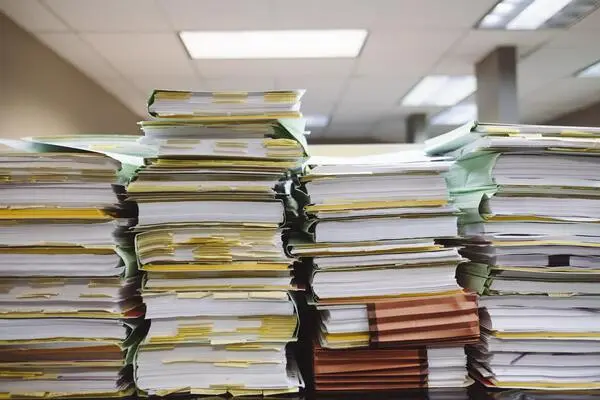

In the intricate world of education systems, the relentless paperwork around purchase requisitions, PO requests, check requests, and invoice processing can feel like a never-ending jungle. Today, we’ll explore a pragmatic journey inspired by the stories of other school districts, like Palm Beach County Schools, steering through the challenges and rediscovering the true focus: education.

Picture your AP team engrossed in the manual jungle of invoice data, researching issues, and lengthy back-and-forths. It's not just a local woe; both vendors and buyers share the consequences of this struggle. So, what can you do?

Palm Beach County, Seminole County, and Walton County Schools have all walked the talk. We’ll give you a couple of examples:

The Palm Beach County Schools case study isn’t a show-off; it’s a nod to the power of districts finding practical relief in an invoice processing and accounts payable automation solution (see case study) where we now have technology to read/OCR an invoice (Paper or electronic image/PDF) and automatically extract the appropriate information from it (Invoice #, PO #, Date, Dollar Amount and line item details if required) and then kick off a workflow process or match the invoice to the PO and then update their accounting system or ERP. This eliminates manual data entry and labor costs, speeds up the overall process, and helps them to avoid mistakes.

Two different school systems in Georgia, are another example: there we’ve taken paper forms or PDFs and converted them to eForms and have related workflows behind them that automate the process, interact with other back-end systems (Accounting/Finance) and then archive it for future storage and retrieval.

The users access the forms in a form library within a browser/portal to kick off the process, and include financial, personnel, contracts, and new hire forms), such as:

Financial:

Personnel:

Contracts:

New Hires:

As we navigate our everyday paperwork chaos, let’s not think of tech solutions as an ad but as practical tools to help you tackle your district’s unique challenges in an efficient and cost-effective way. It’s about finding a breath of fresh air amidst the paperwork turmoil and getting the support you and your team need to steer toward a reality where education is the focal point, and not just a byproduct of never-ending administrative tasks.

Interested in learning how we can support your school system?

In the wide-ranging landscape of educational institutions, the School District of Palm Beach County stands as the tenth largest in the nation and the fifth largest in the state of Florida. With a student body exceeding 189,000, representing a tapestry of 150 languages, it serves as a pivotal contributor to the vibrancy of Palm Beach County. As the largest employer in the region, the district's more than 22,800 employees, including over 12,500 teachers, play a crucial role in shaping the future.

In the backdrop of economic challenges in 2013, the Palm Beach County School Board confronted a daunting task — to streamline operations amidst significant budget reductions. Handling a staggering 175,000 invoices annually, the Accounts Payable (AP) department grappled with a labor-intensive, paper-driven process that proved error-prone. The associated high costs of storing paper invoices and adherence to government mandates on record maintenance added to the complexity.

Faced with these challenges, the School Board sought an integrated solution that would seamlessly meld with existing systems, automating manual processes to trim both time and costs. This is where Informa Software entered the scene, offering a lifeline to the district's operational efficiency.

We’re now in the process of introducing a full end-to-end contract lifecycle management solution that will further automate and optimize the Palm Beach School District’s processes and capabilities. The journey continues, and the possibilities are endless!

So, take a hint from the success experienced by Palm Beach County School District: Integrated automation can revolutionize your document management, boost efficiency, and save you a fortune. It's time to turn the page and embark on your own efficiency-enhancing adventure!

It’s been over 10 years now, and as the journey continues, the district is poised to embrace a full end-to-end contract lifecycle management solution, further automating and optimizing its processes. The success story of Palm Beach County School District serves as an inspiring testament — integrated automation not only revolutionizes document management but also catalyzes efficiency and substantial savings.

"We no longer physically store any paper invoices. They are stored and filed electronically, eliminating the possibility of misfiling a paper invoice (…) Automating many of our manual processes has resulted in increased productivity and significant cost savings."

Heather Knust - Director of Accounting Services Palm Beach County School Board

"We’ve eliminated at least four processes, and invoice management has been accelerated by using a digital workflow right from the start."

Bob Rucinski - AP Manager Palm Beach County School Board

Download our full case study here.

Before we jump into the solutions, let's acknowledge the elephant in the room: your concerns. We know you've got a lot on your plate, and document management might not be at the top of your list, but it should be. Here are some common worries that automation might just dissolve:

Now, let's talk about how automated document management can address these concerns head-on.

Automated document management is like having a team of highly efficient, 24/7 assistants that never complain and never take a coffee break. Here's how it can help you overcome your worries:

With automated document management, paper becomes a relic of the past. You can digitize everything from student records to administrative forms. No more stacks of paper cluttering your office!

Say goodbye to the relentless drain on your budget. You'll save money on paper, printing, storage space, and even postage. Those savings can be reinvested in improving your school or district.

Worried about data security? Automated document management systems come equipped with top-notch encryption and access controls. Your documents will be more secure than Fort Knox.

Imagine having all your documents organized, searchable, and accessible with a few clicks. No more hunting for that elusive record or form. Automated systems can streamline processes and free up your valuable time.

But wait, there's more! Automated document management doesn't just stop at organizing your files; it can seamlessly integrate with your existing systems and workflows to supercharge your school's efficiency.

Tired of handling mountains of enrollment paperwork at the start of each school year? Allow students and parents to complete forms and submit documents online. Records to be instantly updated, and progress tracked without breaking a sweat.

Managing teacher contracts, payroll, and benefits can be a bureaucratic maze. Automated document management simplifies the process. New hires can complete onboarding paperwork electronically, and you can easily track staff records.

Keep your budget in check by automating procurement and budget approval processes. Say goodbye to paper purchase orders and hello to streamlined, digital workflows that save time and reduce the risk of errors.

Education is rife with regulations and reporting requirements. Automated systems can generate compliance reports at the click of a button, ensuring your school or district stays on the right side of the law.

Keep parents in the loop with automated communication tools. Send permission slips, announcements, and newsletters electronically. It's not just efficient; it's eco-friendly too.

Document management is your secret weapon to conquering paperwork, saving money, and boosting efficiency. It tackles your major concerns by eliminating paper clutter, streamlining processes, enhancing security, and giving you back the gift of time.

Remember, in the digital age, there's no reason to be buried under piles of paper. Embrace automation, integrate it into your systems, and watch your school or district thrive!

So, why wait? Say goodbye to the paperwork nightmare and hello to a brighter, more cost-effective future for your educational institution. ???

Navigating the ever-changing tech waters can feel like a high-stakes adventure, especially when you're dealing with the complexities of document management. As a CTO, you've likely grappled with a few nautical nightmares:

1. Resource Drought: The dread of lacking the internal manpower to execute a seamless integration journey.

2. Complexity Storms: Navigating the turbulent waters of integration complexities without a seasoned guide.

3. Risk Reef: Worrying about potential disruptions and bottlenecks that could steer your business off course.

Hold tight, brave captain of technology, because expert integration support is your compass to guide you through these choppy waters!

Picture this: you're at the helm, steering your ship, and an experienced navigator appears by your side, guiding you through every twist and turn. That's the power of external integration support. By enlisting the aid of experts, you're embarking on a voyage that not only guarantees a safe journey but also promises to uncover hidden treasures along the way.

Are you sailing on the high seas of inefficiency, wasting precious time and resources trying to navigate integration complexities? External support comes to the rescue, turning your skeleton crew into a powerhouse team of integration virtuosos.

With experts at your side, you can expect streamlined workflows that rival the precision of a Swiss watch. Say goodbye to the days of lost documents and hello to an era of seamless document processing that frees you up to focus on charting your business course.

Integration challenges can feel like a tempest that threatens to capsize your ship. But with external support, you're gaining a crew of skilled sailors who know these waters like the back of their hand.

From system compatibility to data synchronization, the experts have seen it all. They'll help you navigate through the stormy seas of complexity, ensuring your integration journey is smooth sailing from start to finish.

Ahoy, risk-averse sailors! Worried about hidden reefs that could shatter your integration dreams? Expert integration support is your trusty treasure map, guiding you away from potential pitfalls.

Our seasoned navigators have encountered treacherous waters before and know how to steer clear of disruptions. With their guidance, you can be confident that your integration voyage will reach its destination safely, with minimal risks and maximum rewards.

Now, you might be wondering, "Okay, but how does expert integration support truly steer my ship towards business success?"

External support bolsters your team with the expertise needed to execute a flawless integration. You'll witness a boost in productivity and efficiency, without straining your internal resources.

Say goodbye to sleepless nights spent worrying about integration hiccups. With experts by your side, you can confidently navigate through the complexities, ensuring a seamless and stress-free journey.

Time is money, and expert support accelerates your integration timeline. This means quicker returns on your investment, as your business reaps the benefits of enhanced efficiency and streamlined processes.

It's time to hoist your sails and embark on a journey of business brilliance. Expert integration support is your ticket to sailing through the integration storm with confidence and precision.

With boosted efficiency, conquered complexities, and minimized risks, you're not just steering your ship – you're navigating it towards the harbor of success. Embrace the magic of external support, and help your business achieve new heights of efficiency and prosperity! ⚓?

Hey there, fellow document wizards! ?✨ If you're a proud member of the DocuSign family, you already know the magic it can bring to your document management game. But what if I told you there's a way to take that magic to a whole new level? ? That's right, we're diving into the realm of effectively integrating your entire document processing systems to boost efficiency and skyrocket your business success! ??

We get it – managing documents can feel like a never-ending quest, complete with dragons of deadlines and labyrinthine approval processes. You've probably had your fair share of worries:

1. Lost in the Abyss: The fear of documents disappearing into the digital ether, never to be seen again.

2. Approval Armageddon: Wrestling with approvals that could rival a cosmic clash of titans.

3. Data Disarray: Juggling multiple systems and struggling to keep your data organized and up-to-date.

But there is good news! Full integration is here to rescue you from these complex document dilemmas!

Picture this: all your systems, apps, and software working in harmony, like a symphony of efficiency. That's the beauty of effective integration. By weaving DocuSign into the fabric of your existing processes, you're about to embark on a journey of streamlined productivity that will leave your competition eating your digital dust.

Imagine your documents flowing seamlessly from creation to approval, with DocuSign acting as the virtuoso conductor of your digital orchestra. Integration allows you to automate and synchronize tasks, reducing manual errors and freeing up your valuable time for more strategic endeavors.

Let's face it, nobody wants to spend hours shuffling papers and chasing signatures. With integration, you're taking a one-way trip out of the paper jungle and into the fast lane of digital efficiency.

Ah, the dreaded data disarray – we've all been there. But release your fears because integration brings a cavalry of order to your data chaos. With all your systems linked up, your data becomes a harmonious symphony, playing in perfect tune.

Need to pull up a client's information? No more wild goose chases through scattered databases. Integration empowers you to access accurate data at your fingertips, making you the maestro of informed decisions.

The realm of approvals can be a treacherous one, filled with bottlenecks and frustration, but integration holds the key to taming this beast. Picture this: approvals happening seamlessly, with notifications popping up like magical breadcrumbs, guiding you and your team through the process.

No more endless back-and-forths, no more lost emails, and definitely no more nail-biting over missed deadlines. Integration not only expedites approvals but also lets you track the entire process, giving you the power to keep everything on track.

Now, you might be thinking, "Alright, integration sounds like a pretty epic adventure. But what's in it for my business?" Well, the short answer is: Success, with a capital "S"!

How?

Say goodbye to wasted hours and hello to heightened productivity. Integration slashes manual tasks, leaving you with more time to focus on strategies that drive growth.

With streamlined processes, your clients get what they need faster. Happy customers? That's the golden ticket to building strong, lasting relationships.

Accurate, real-time data is your compass in the business wilderness. Integration ensures you're always making decisions based on the freshest insights.

At the end of the day, integration is like the X-factor in your quest for business domination. It's the secret weapon that can propel your efficiency and success to legendary heights.

So, fellow DocuSign users, it's time to embrace the magic of real integration and watch your document management soar to new heights. With seamless workflows, organized data, and approvals tamed, you'll be the hero of your own business saga.

Get ready to conquer the document dragons, slay the approval beasts, and unlock a realm of efficiency and success you never thought possible. Your journey begins now – let’s integrate and elevate, one digital document process at a time! ?️?

We all know by now that in a fast-paced business environment, efficiency is the name of the game. You've got an entire team working tirelessly to process as many documents and applications as possible, but with limited resources.

Well, take a deep breath now, because the secret to overcoming these challenges lies in the power of automation! Yep, we're talking about fully automating those document management, archiving, and e-signature processes.

And we don’t mean using pdfs: actually leveraging end-to-end automation is like having a supercharged sidekick that can revolutionize your workflow, streamline operations, and boost productivity!

So, in this blog post, we're going to dive deep into why automation is so important. Trust me, it's a game-changer!

Imagine waving goodbye to manual, time-consuming tasks and saying hello to a more efficient and seamless process… Well, buckle up as we take a journey into the world of automation and discover how it can transform your business for the better! Let's get started!

We all agree: managing a vast array of documents can be a daunting task, but true, integrated, end-to-end process automation can definitely help you:

Say goodbye to bulky file cabinets and stacks of paperwork. Digitize and store all your loan applications, forms, and supporting documents in a centralized, secure, and easily accessible digital repository. No more printing and storing. No more searching through physical files or worrying about misplaced documents.

Manual indexing can be time-consuming and error-prone. With real automation, you can automatically extract key information from documents and apply relevant metadata tags. This ensures accurate indexing, improves searchability, and saves valuable time that can be spent on more critical tasks.

Automation enables the creation of streamlined document workflows. You can automate document routing, approval processes, and task assignments, ensuring documents move seamlessly through various stages of the lending process. This helps eliminate bottlenecks, reduce delays, and enable faster decision-making.

Simplify the archiving process by automatically categorizing and storing documents based on predefined rules and criteria. You can set up rules to automatically archive closed loan applications, expired documents, or documents that have reached a specific age. This ensures compliance with retention policies and frees up valuable storage space.

Searching for specific documents in a massive digital repository can be a time-consuming task. Automation allows for advanced search capabilities, where you can quickly locate documents based on various criteria such as customer name, loan number, or document type. This boosts productivity, reduces frustration, and enables faster response times to customer inquiries.

Automation enables seamless integration with different e-signature platforms, allowing borrowers to sign documents electronically. This eliminates the need for printing, mailing, and manual processing of physical documents, saving time and resources while improving the borrower experience.

With automation, you can create automated workflows for e-signature processes. You can set up triggers that initiate e-signature requests, send reminders, and track the status of signatures. This ensures a smooth and efficient e-signature experience for both borrowers and internal stakeholders.

Automation ensures compliance and security in e-signature processes. By utilizing platforms with built-in security features, you can maintain the integrity and authenticity of e-signed documents. Additionally, automation helps in tracking and recording the entire e-signature process, creating an audit trail that satisfies regulatory requirements.

As you can see, automation in document management, archiving, and e-signature processes is the ultimate key to unlocking efficiency and productivity. By leveraging true, end-to-end automation, you can streamline your workflows and optimize your resources to achieve better results with less errors, friction, and time!

Are you ready to revolutionize your business operations and unlock the path to success?

It's time to bid farewell to tedious paper-based processes and embrace integrated, end-to-end automation. We know closing loans remotely, quickly, and effectively while reducing errors is the ultimate goal, and we have just the solution for you.

Join us as we dive into five paper-based processes totally worth automating, and discover how this transformative shift can bring better business results. Let's get started!

Processing loan applications can be a daunting task, filled with paperwork and manual data entry. Automating this process eliminates the need for physical documents and enables the seamless flow of information. By leveraging intelligent data capture systems, you can extract key data points, verify applicant information, and accelerate the approval process. Say goodbye to mountains of paperwork and hello to a streamlined loan application journey!

Verifying documents manually is time-consuming and prone to errors. Embrace automation by utilizing document verification tools that employ optical character recognition (OCR) technology. These tools can extract relevant information from documents, cross-reference it with existing databases, and flag any discrepancies. With automated document verification, you can ensure accurate and swift processing, minimizing the risk of errors and ensuring compliance.

Determining the creditworthiness of loan applicants is a critical step in the lending process. Automate credit scoring using advanced multi-source data analytics that provide answers in minutes! These tools can help you analyze vast amounts of data, including credit history, financial records, and market trends, to generate accurate credit scores. By automating credit scoring, you can make informed lending decisions quickly, minimizing manual effort and increasing efficiency.

Navigating the complex landscape of compliance regulations can be a challenge. Automate compliance management using dedicated software that monitors regulatory changes, updates policies, and performs real-time compliance checks. This ensures that your loan processes adhere to industry regulations and mitigates the risk of penalties or legal issues. By automating compliance management, you can stay ahead of the game and focus on delivering exceptional customer experiences.

Gaining actionable insights from heaps of data is no small feat. Automate your reporting and analytics processes using business intelligence tools that can integrate to the systems your business already has. This will help you aggregate, analyze, and visualize data in real-time, providing valuable insights into loan performance, customer behavior, and market trends. By harnessing the power of integrated reporting and analytics, you can make data-driven decisions, identify opportunities for improvement, and drive business growth in minutes!

And there you have it: automate these five paper-based processes and you’re on your way to success.

Let the revolution begin!

In the fast-paced digital era, successful consumer lending companies are embracing a transformative shift to meet the needs of the modern borrower. By combining innovation, empathy, and efficiency, these lenders are revolutionizing the borrowing experience. In this blog post, we will explore how consumer lending firms are redesigning their processes, leveraging technology, and adopting customer-centric approaches to create a seamless and empowering lending journey for borrowers, and sustained business success for themselves.

So, how do you actually begin to drive this change and align your business to the modern borrower?

To redesign consumer lending, it is crucial to empathize with the borrower's journey. Lenders are investing in comprehensive research to gain insights into borrowers' pain points, preferences, and needs. By understanding the challenges borrowers face and their expectations, lenders can tailor their processes and offerings accordingly, enhancing the overall borrowing experience.

Digital transformation lies at the core of redesigning consumer lending. Lenders are leveraging advanced technologies to streamline their operations. By digitizing processes, borrowers can access loan applications, submit documentation, and track their progress conveniently through user-friendly online platforms and mobile applications.

Recognizing that borrowers have diverse financial needs, consumer lending firms are moving away from one-size-fits-all approaches. Through advanced data analytics, alternative credit scoring models, and easy-to-use complex calculation engines, lenders can personalize loan offerings based on borrowers' unique circumstances. This inclusive approach allows lenders to extend credit to individuals with limited credit histories or unconventional financial profiles, catering to a broader range of borrowers.

Cumbersome documentation requirements have been a longstanding pain point in consumer lending. To address this, lenders are adopting mobile-enabled document submissions. Borrowers can capture and submit necessary documents directly from their smartphones, eliminating the need for manual paperwork and physical visits. This simplification not only enhances convenience but also expedites the loan approval process.

Redesigning consumer lending involves fostering transparent and proactive communication channels. Lenders are leveraging technology to provide instant and personalized information and support to borrowers. Through these platforms, lenders can access accurate information in real time, and borrowers can receive prompt responses to their queries, receive updates on their loan applications, and gain access to financial advice throughout their lending journey.

Data is a valuable asset for consumer lending companies. By harnessing the power of data analytics, lenders can gain insights into customer behavior, identify trends, and make data-driven decisions. By leveraging predictive analytics, lenders can proactively identify potential defaults, optimize pricing strategies, and create tailored loan products that meet the unique needs of individual customers.

In an era of increasing cybersecurity concerns, building trust and ensuring data security are paramount. Lenders are prioritizing robust security measures, complying with regulations, and communicating their privacy policies clearly. By adopting secure digital document storage and vaulting systems, and providing borrowers with transparent processes, and ethical data handling practices, lenders can foster trust and instill confidence in their borrowers.

By redesigning consumer lending with a focus on customer needs and business efficiency, lenders are revolutionizing the landscape. Through digital transformation, personalized offerings, simplified documentation processes, enhanced communication, and a strong commitment to trust and security, lenders are creating new rules of success. This is a market we know and are familiar with: our software solutions enable lenders to capture and analyze vast amounts of data, providing actionable intelligence for risk assessment, fraud detection, and personalized lending offers.

As consumer lending continues to evolve, it is a combination of empathy, trust, and efficiency that will define success and drive the industry forward.

Streamlining contracts efficiently is critical for any business because it reduces the risk of penalties, liabilities, and additional errors. A recent DocuSign survey revealed that businesses enjoyed an 80 percent reduction in contract drafting time and a 50 percent decrease in overall contract completion time after implementing Contract Lifecycle Management (CLM) solutions. That is why we’ve decided to map out a few contract lifecycle management best practices for our clients!

These practices can save your organization from losing thousands of dollars by eradicating compliance issues and mitigating human errors. Furthermore, businesses must keep up to date with the latest technologies in order to stay one step ahead of their competitors. Choosing contract lifecycle management best practices will undoubtedly help your organization achieve efficiency, productivity, and, ultimately, long-term success.

Before we step into the contract lifecycle management best practices discussion, we must get a heads-up on what it really is.

In simple words, Contract Lifecycle Management or CLM is the automated management of an organization’s contracts. From drafting and reviewing to approval and execution of contracts, everything is a part of contract lifecycle management.

CLM also allows businesses to keep digital records of their contracts and never lose vital data. In short, contract lifecycle management streamlines and secures all the critical data related to contracts.

Contracts always keep businesses juggling through the complexities of negotiations, documentation, and never-ending modifications. Between this chaos, there’s a high probability of erroneous payments and unintentionally missing out on contractual obligations.

So, CLM best practices will assist your business in the following ways;

According to DocuSign, after implementing a CLM solution, the average business sees a 50% reduction in contract completion time.

Despite the unparalleled benefits of contract lifecycle management best practices, 55 to 70 percent of businesses around the globe are still not practicing them. The most obvious reason is the lack of awareness of pursuing such methods.

Well, if your organization has recognized the importance of implementing best contract management practices, then you just need to stick with us until this article's end. We’ll make it effortless for your business to progress toward technological advancements.

Companies waste a lot of time arranging contracts' paperwork to finalize the agreements. Wasting time halts their productivity and causes extended delays in closing deals. In addition, manual processes can cause human errors.

1,170 out of 1,300 contracting professionals reported nine out of 10 firms are burdened by manual agreement processes, and human error is the major burden to their business’ contracting process. Generally, human errors cause 37 percent delays in closed deals while increasing the costs involved by 34 percent.

Docusign

However, your organization can easily overcome such issues if you have automated contract templates beforehand. You might be wondering how to design such templates that can comply with the variations in different contracts.

Well, the right way to design a template that ensures full-fledged compliance is by:

So, well-designed automated templates will not only save you time but will reduce your operating and processing costs by 10 to 30 percent. At Informa, for example, we helped one of our clients reduce document maintenance by adding dynamic merge tags that reduced 300 unique documents to 30 customizable templates

One of the contract management best practices that’ll assist your business in arranging real-time collaborations with your clients is by incorporating cloud-based solutions.

The key benefits of this contract management practice include the following;

So, making contracts available online will surge the efficiency, security, and accuracy of your contract lifecycle management workflow.

You have designed template libraries and uploaded them on the cloud, but the risk of missing out on legal obligations remains. You can overcome such risks by introducing automated notifications regarding contract expiration and renewal dates.

Automated alerts will allow your team to stay one step ahead of their obligations, responsibilities, and critical deadlines. Reduction of risk potentials and mitigation of financial risks can be easily carried out via automated notifications. Indeed, it is one of the best CLM practices for which every organization shall opt.

70 to 80 percent of business deals and transactions are done via contracts. However, all the contracts do not hold the same worth. Some of them are low-value, while some are high-value.

Low-value contracts can be efficiently dealt with by the HR department and don’t require the involvement of a lawyer.

On the other hand, a business can’t proceed with high-value contracts without the supervision of a lawyer.

Businesses spend a substantial sum of money because lawyers supervise their low-value contracts while they can be efficiently executed by the HR or sales representatives. So, by segregating low-value contracts from high-value ones, a business can save a decent amount spent on lawyers for unnecessary low—value contracts.

Your business shall carry out some critical security measures, especially if you have incorporated a cloud-based interface. No doubt that the cloud makes it easy to access everything in a matter of seconds from anywhere in the world. However, it adds up associated risks if not managed appropriately.

Your company can protect its clients' sensitive data by incorporating feature-based permissions and multi-factor authentication. This way, your organization can guarantee secure access to the contracts and make sure that no compromise on security is made.

As explained earlier, contracts require collaborative efforts; and collaboration demands transparency. In general, usually, two departments work in handling the contract lifecycle:

There might be external stakeholders to be part of this process. During the contract development phase, multiple issues may arise. Let’s take an example where the legal and finance departments are working on drafting a contract.

Among these two, legal is more concerned about the accuracy of execution to ensure compliance with legal requirements. In contrast, the finance department is usually more titled on quick result generation. So, conflict may arise.

Contract lifecycle management best practices to prevent the occurrence of such conflicts include;

On top of that, avoiding dependence upon individuals is ideal to ensure a seamless flow. Their absence shouldn’t significantly impact the overall progress of work. All these practices can combine to inject transparency into the system while eradicating the chances of potential conflicts.

To conclude, we can say that by opting for the contract lifecycle management best practices, your business can pave the road toward guaranteed success.

You’ll be intrigued to know that some incredible software and tools are available which allow the automation of contracts by incorporating the latest technologies. At Informa Software, we partner with DocuSign to make your contract management journey effortless.

Just get in touch with us to streamline your processes and pace up your digital transformation with innovative solutions.